Car Insurance for Travel Nurses

Travel nurses have unique needs when it comes to car insurance. From legal requirements to liability and comprehensive coverage for frequent travel, there are many factors to consider when selecting the right car insurance policy. In this article, we explore the ins and outs of car insurance for travel nurses. We'll discuss why travel nurses need car insurance and the different types of coverage available. We will also offer tips for comparing car insurance providers and customizing policies to meet the unique needs of traveling healthcare professionals.

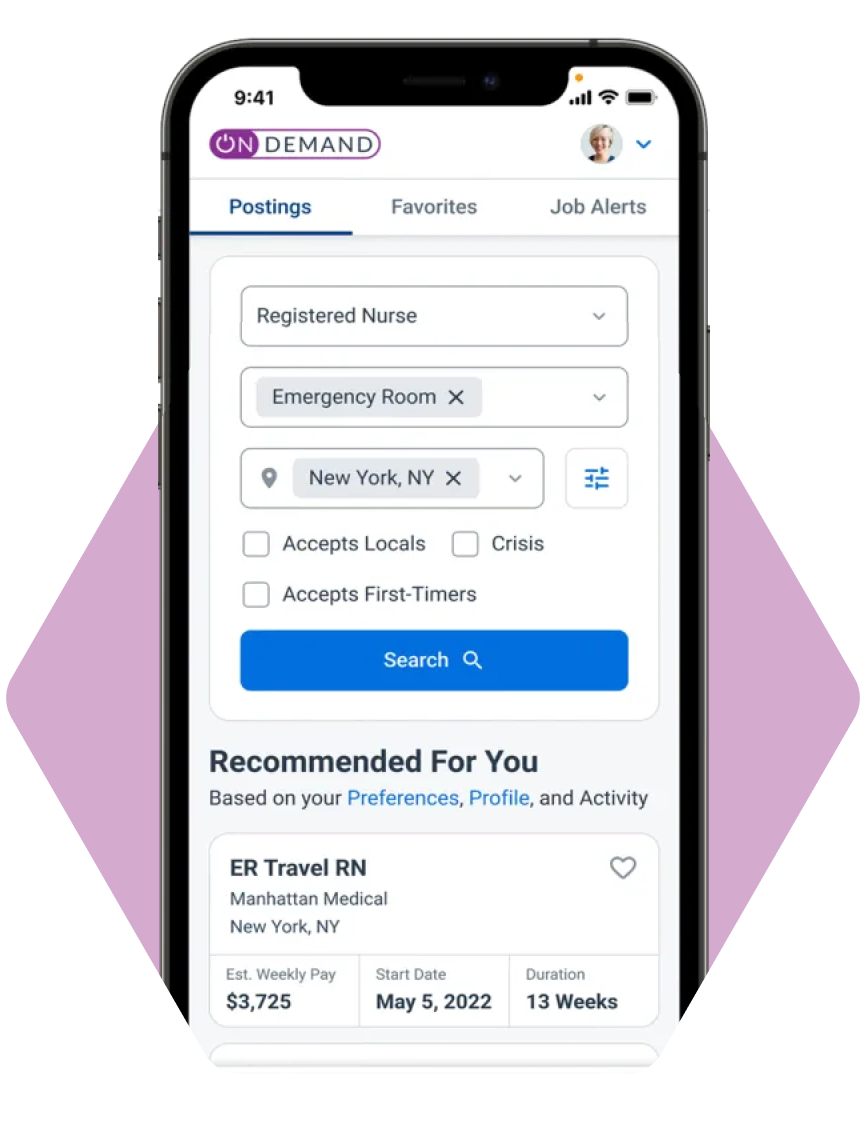

{{cta-light-with-image-tall}}

Why Travel Nurses Need Car Insurance

Travel nurses play a critical role in providing healthcare services to different communities. With their work requiring frequent travel, it is paramount for them to have reliable car insurance. Auto insurance companies offer policies designed to cater to the unique needs of medical professionals like travel nurses.

Having adequate car insurance not only gives travel nurses peace of mind but also ensures that they can legally and safely perform their duties. In this article, we will discuss the different aspects of car insurance for travel nurses, including legal requirements, liability protection, and comparing insurance companies for the best coverage.

Legal Requirements and Liability Protection

All states require car owners to have a minimum level of auto insurance coverage, making it essential for travel nurses to have at least a basic insurance policy. The primary purpose of auto insurance is to protect drivers against financial losses due to accidents, theft, or other unforeseen situations. Insurance companies offer different types of coverage, including liability protection, which is a legal requirement in most states.

When travel nurses have liability insurance, they are protected against the financial burden of compensating another party when they are at fault in an accident. Insurance companies provide coverage for bodily injury and property damage, ensuring that the travel nurse is not personally liable for the costs. A car insurance company may also offer uninsured and underinsured motorist coverage, protecting the policyholder if they are involved in an accident with a driver who has insufficient insurance or none at all.

Collision and Comprehensive Coverage for Frequent Travel

Travel nurses spend the majority of their time on the road, often driving in unfamiliar and challenging conditions. Collision insurance is essential for these healthcare workers, as it covers damages to their vehicle in case of an accident with another car or object. Auto insurance companies offer collision coverage, ensuring that the policyholder is protected from expenses related to repairs or vehicle replacement.

In addition to collision coverage, comprehensive car insurance is crucial for travel nurses. Comprehensive coverage protects against damages caused by incidents other than collisions, including theft, vandalism, fire, and natural disasters. This type of coverage can be especially beneficial for travel nurses who are frequently away from home, as it offers protection against unexpected events that can lead to costly repairs or vehicle loss.

Unforeseen Circumstances and Emergencies

Travel nurses may face numerous unpredictable situations while on the job. While some incidents can be anticipated, others can occur out of the blue and put healthcare workers in emergency situations. By having the appropriate auto insurance policy, travel nurses can ensure they have the necessary coverage to protect themselves and their vehicles.

For instance, insurance companies often offer roadside assistance as an add-on to auto insurance policies. This feature can provide valuable support to travel nurses in need of a tow, jumpstart, or other emergency services. Additionally, having adequate medical coverage as part of an auto insurance policy can ensure that healthcare workers receive the proper care in the event of a car accident.

Comparing Car Insurance Providers for Travel Nurses

When looking for car insurance, travel nurses should use an auto insurance comparison platform to assess multiple companies and policies. A free auto insurance comparison tool can help identify which insurance provider offers the best coverage and car insurance rates tailored to healthcare professionals. By comparing policies from multiple companies, travel nurses can find cheap auto insurance rates without sacrificing essential coverage.

When using an auto insurance comparison platform, travel nurses should search for auto insurance discounts specifically for medical professionals. Many car insurance companies recognize the vital role healthcare workers play and offer specialized discounts. For example, some top companies may provide a car insurance discount for nurses, resulting in lower insurance rates and saving money in the long run.

The Main Factors to Consider

Before selecting an auto insurance company, travel nurses should consider several factors that can affect their coverage and car insurance rates. These may include:

- The state's minimum coverage requirements

- The value of their vehicle

- Driving history and frequency of travel

- Optional coverages, such as roadside assistance and rental car reimbursement

- Discounts available for healthcare workers

- Customer reviews and financial stability of the insurance company

By considering these factors when shopping around, travel nurses can make an informed decision and select the insurance company that best fits their needs and budget.

Customizing Car Insurance Policies for Traveling Professionals

Travel nurses have unique insurance needs due to their mobile lifestyle, and they should customize their car insurance policy to address those specific requirements. Customization options could include having a higher liability limit due to frequent travel or opting for a full coverage policy with both collision and comprehensive coverage for greater protection.

Moreover, it is essential for travel nurses to communicate their profession to the insurance company, as this can lead to increased eligibility for discounts and tailored policies. By working closely with their chosen insurer, travel nurses can create a personalized auto insurance policy that accommodates their transient work life and provides the necessary coverage and protection on the road.

Managing and Maintaining Car Insurance While on Assignment

As a job seeker or someone who often goes on work assignments, it's essential to manage and maintain your car insurance coverage effectively.

One crucial aspect of managing your car insurance is to regularly compare auto insurance rates from different companies. A free auto insurance comparison tool can help you find the best deals and discounts available from various companies, thereby enabling you to select the most suitable car insurance company for your needs and save money on premiums.

Another critical aspect is ensuring that your insurance coverage is continuously updated to reflect your current situation. This involves updating your information and address changes, as well as checking whether your car insurance company offers rental car insurance and reimbursement when required.

Updating Information and Address Changes

When you change your address, it's crucial to update your auto insurance policy accordingly. Not doing so might result in your car insurance coverage becoming invalid or inaccurate and may cause problems in case of an accident or claim. Furthermore, if you move to a different state, you may be subject to different auto insurance regulations and requirements.

To update your address, contact your car insurance company and provide them with your new address and any updated information. Keep in mind that the changes in your location may affect your car insurance rates. For example, some areas are considered high risk for theft or accidents, while others may have lower risks. Consequently, your auto insurance company might increase or decrease your auto insurance rates based on your new address.

Moreover, certain life changes, such as marital status or even your profession, can result in a different car insurance discount. For instance, healthcare workers might qualify for specific auto insurance discounts that were not applicable before. Make sure to provide your insurance company with all updated information, so you don't miss out on any auto insurance discounts.

Rental Car Insurance and Reimbursement

When on assignment, you might be using rental cars frequently, or you might be required to use your car for work-related purposes. In such situations, it's crucial to ensure that your auto insurance coverage adequately covers rental cars or provides reimbursement for work-related expenses.

Some car insurance companies offer rental car insurance as part of a full coverage policy, while others might require you to purchase additional coverage. Before renting a car, check with your insurance company to see if your current auto insurance policy covers rental car insurance. If not, you may have to buy rental car insurance coverage from the rental car company itself.

If your job requires you to use your car for work-related engagements, your current auto insurance policy might not offer sufficient coverage. In some cases, personal auto insurance coverage may not cover accidents or damages resulting from work-related use. So, make sure to disclose your work-related car usage to your insurance company to ensure proper insurance coverage. Many insurance companies offer a separate business use policy with additional coverage for such situations.

Keep in mind that some auto insurance companies offer reimbursement for rental car insurance or work-related car use expenses. It's essential to check with your car insurance company regarding their reimbursement policies and submit the necessary paperwork to claim such reimbursements.

In conclusion, managing and maintaining car insurance while on assignment involves keeping track of changes in your personal information, address, and work-related car usage. Regularly checking and updating your auto insurance policy will ensure that you have accurate coverage, enabling you to avoid potential difficulties in the future. Additionally, leveraging free auto insurance comparison tools can help you find the most suitable car insurance company, coverage, and rates according to your current needs and circumstances.

GET STARTED IN

Land your dream job faster when you travel with us. Get started with top local and national travel nurse jobs in On Demand.

GET STARTED IN

Land your dream job faster when you travel with us. Get started with top local and national travel nurse jobs in On Demand.

GET STARTED IN

Land your dream job faster when you travel with us. Get started with top local and national travel nurse jobs in On Demand.

GET STARTED IN

Land your dream job faster when you travel with us. Get started with top local and national travel nurse jobs in On Demand.

View Top Jobs in

Search, apply and be the first in line for your dream job today.

View Top Jobs in

Search, apply and be the first in line for your dream job today.

Apply to Top Jobs in

Search, apply and be the first in line for your dream job today.

Get Started in

Search, apply and be the first in line for your dream job today.

Take Control of Your Career with

Search, apply and be the first in line for your dream job today.